Ready to see Qobra in action? Discover and try our platform now for free

Product TourDo you know how much of your sales are commission-based? Have you ever wondered about the fairest way to determine this percentage? Whether you're a salesperson looking to increase revenue, or a manager tasked with developing incentive plans, it's essential to understand commission rates and how to calculate them.

Understanding commission rates

A commission rate represents the percentage of a sale that goes to a salesperson or agent. It serves several key functions:

- Align commissions with the definition of the company's objectives

- Rewarding high performance in a transparent manner

- Simplifying forecasting and budgeting for labor costs

By setting clear rates, companies foster trust among their teams. Everyone knows exactly how much they earn for each deal closed, eliminating any gray areas.

Still have doubts? Here is a clearer definition of commission rates.

Factors influencing commission rates calculation

- Industry norms and competitive benchmarks

- Profit margins on products or services

- Complexity of the sales process (long cycles vs. quick transactions)

- Volume expectations or individual quotas

- Frequency of recurring revenue vs. one‑time sales

- Type of commission (fixed, variable, progressive, etc.) established within the company according to the commission plan

How are commission rates calculated?

There are two main methods for calculating commission percentages:

- From sales to commission amount

- From commission amount back to rate

1. Calculation of the sales commission amount

Use this formula to find the commission earned on a sale:

- Commission amount = Sale price × Commission rate / 100

For example:

- Sales price = $70.00 - Rate = 14% - Commission = $9.80

- Sales price = $150.00 - Rate = 10% - Commission = $15

- Sales price = $500.00 - Rate = 7.5% - Commission = $37.50

You can also calculate net revenue when the seller covers the cost:

- Real revenue = Sale price – (Sale price × Rate / 100)

In our widget example: $70 – ($70 × 14 / 100) = $60.20

Or, if the buyer pays on top of the base price:

- Price with commission = Base price + (Base price × Rate / 100)

$70 + ($70 × 14 / 100) = $79.80

2. Determine the commission rate based on known figures

When you know the commission amount and total revenue, find the rate like this:

- Commission rate (%) = (Commission amount / Total sales) × 100

For instance, if a rep earns $1,000 on $40,000 sales: (1,000 / 40,000) × 100 = 2.5%

Excel formula for a quick calculation

If you still prefer a spreadsheet, use :

In cell A3: = (A1 / A2) * 100

Where A1 is Commission Amount and A2 is Total Sales.

Practical examples and walk‑through

Example A: Salesperson Commission

- Base price: $100

- Commission rate: 12%

Calculation:

- commission = 100 × 12 / 100 = $12

- net revenue (seller pays) = 100 – 12 = $88

- price with commission (buyer pays) = 100 + 12 = $112

Example B: Reverse‑Engineering Your Rate

- You earned $2,500 in commissions

- Your total closed deals sum to $50,000

Rate = (2,500 / 50,000) × 100 = 5%

These clear steps ensure you always know where you stand and how to plan your targets.

Tools and calculators for your commission rate

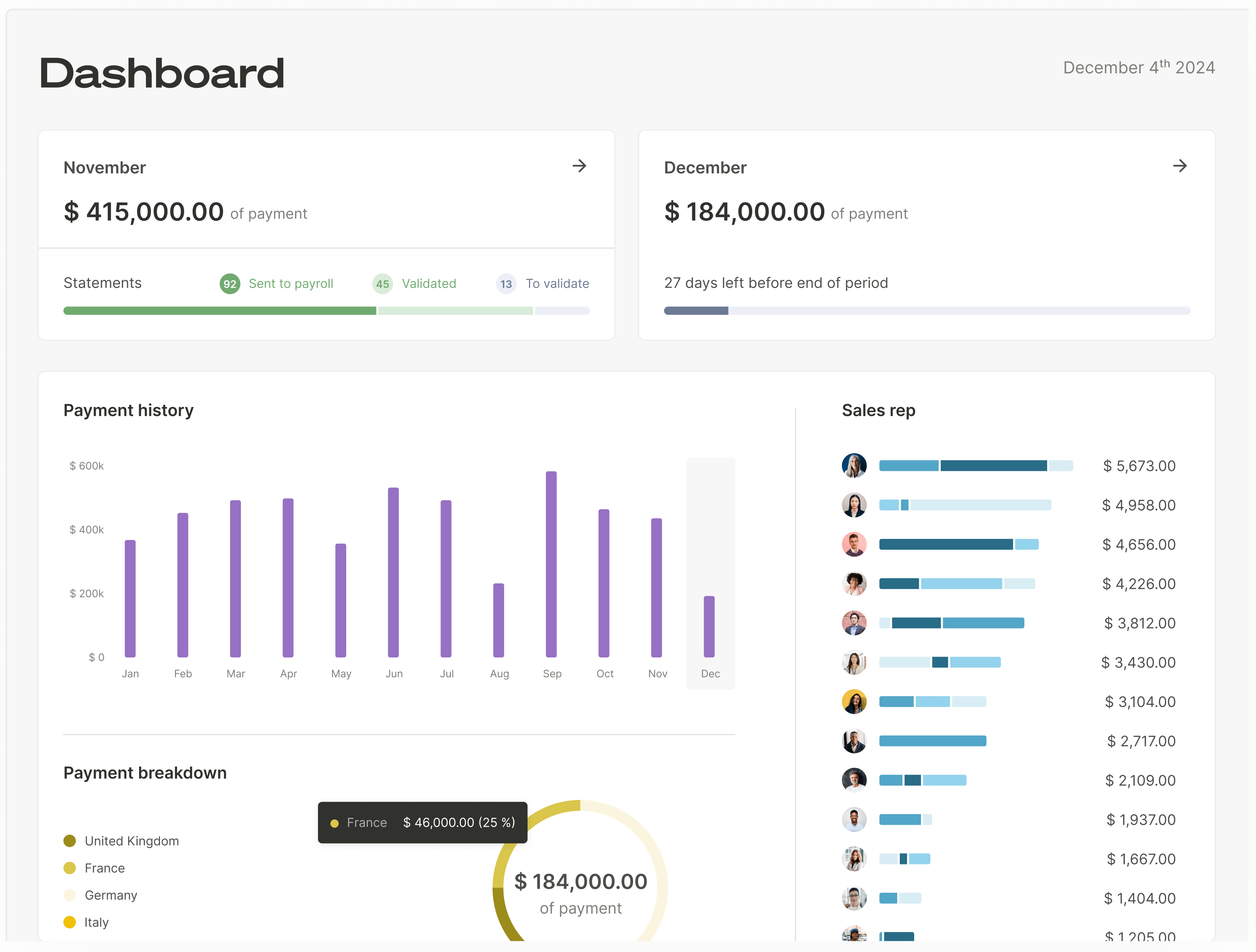

Manual spreadsheets (Excel, Google Sheets) are often a source of errors and slowdowns in commission calculations. Some platforms allow you to automate commission calculations:

- Real-time updates when transactions are completed

- Native integrations with CRMs (HubSpot, Salesforce, Pipedrive, etc.)

- Simulation mode to simulate multiple scenarios

- Interactive dashboards for sales reps, managers, and finance teams

By replacing your Excel for variable compensation with a unified SaaS solution, teams save days each month and reduce payroll disputes.

By replacing Excel for sales commission files with a unified SaaS solution, teams save days each month and reduce disputes over pay.

“We don't need someone spending a whole month managing commissions. Qobra does it very efficiently for us. Now that we've brought a lot of transparency to commissions, especially how they work, it really boosts the sales team's confidence and also motivates them.”

Fabian Q. Veit, CEO at Make

Calculate commissions for different sectors

Different sectors adopt different methods and models to balance commissions and cost control:

- Average commission rate for manufactured goods: 7-15% of the sale value

- Average commission rate for services and consulting: 20-50% thanks to reduced material costs

- Average commission rate for real estate: 5-8% split between real estate agents responsible for sales and purchases

- Average commission rate for software and subscriptions: Often multi-tiered, e.g., 10% on the first $50,000, 15% thereafter

- Average commission rate for retail and e-commerce: 5-12%

- Average commission rate for insurance: 10-20%

- Average commission rate for financial products: 1-5%

- Average commission rate for telecommunications and SaaS: 8-15%

Commission rates and sales reps motivation

It is well known that commissions are a powerful motivator. To be effective, they must meet three fundamental principles:

- Alignment of rates with objectives:

- Well-calculated rates directly reward performance (e.g., sales, renewals), encouraging salespeople to prioritize actions that are profitable for the company.

- Progressive models (e.g., higher rates after a quota) stimulate extra effort.

- Transparency and fairness of commission rates:

- Clear and predictable rates (as recommended by Vladimir Ionesco) eliminate doubts about earnings, strengthening trust.

- Access to real-time dashboards allows teams to track their progress and anticipate their income.

- Eliminate the risk of errors and inequality:

- Manual or opaque calculations generate errors and disputes, undermining motivation.

- Rates that are not in line with market realities (e.g., too low vs. industry standards) or product margins may seem unfair.

Commission rates calculation: Guarantee fairness and transparency

“A sales compensation plan must be clear, simple, transparent, and predictable in order to foster a climate of trust. It is essential to provide 100% visibility on the model, the amounts, and the objectives to ensure that everything is clear from the outset.”

Vladimir Ionesco, Director of Global Sales Performance at Doctolib

- Define roles and who bears commission costs

- Publish dashboards so every rep sees their progress

- Schedule periodic reviews to adjust rates or quotas

Maintaining an audit trail of every change prevents misunderstandings and builds trust.

Whether you’re drafting a new plan or fine‑tuning an existing one, clarity in calculating and communicating rates is the backbone of a motivated sales force.

Craft your commission strategy with confidence, automate where possible, and watch performance and satisfaction climb.

FAQ - Calculate Commission Rates

What factors should I weigh when choosing a commission rate?

Consider industry benchmarks, product margins, average deal size, and sales cycle length. Tailor rates to encourage desired behaviors—be it upselling, renewals, or new customer acquisition. Consult our guide to learn how to build your own compensation plans in complete safety.

How do I calculate my total earnings if I know the rate and sales?

Multiply your commission rate (in decimal form) by total sales: earnings = rate/100 × total sales.

Can commission rates change mid‑year?

Absolutely. Use simulation tools—like Qobra’s sandbox—to model impacts before applying changes. Communicate transparently on the progress of the commission plan to maintain morale.

How do I handle refunds or cancellations?

Incorporate clawback rules: if a deal reverses within a certain period, reclaim the commission. Automate this in your commission management platform to avoid manual adjustments.

Which tool is best for commission calculations?

To fin the best sales commissions tool, look for real‑time automation, CRM integrations, transparent dashboards, and forecasting capabilities.

.webp)